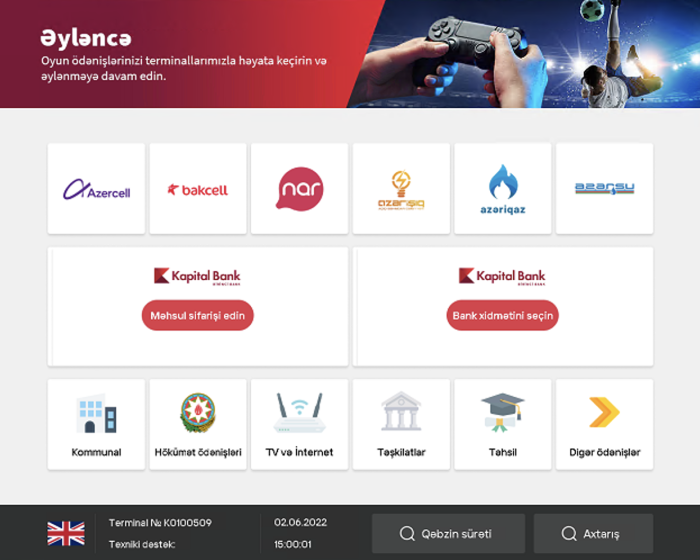

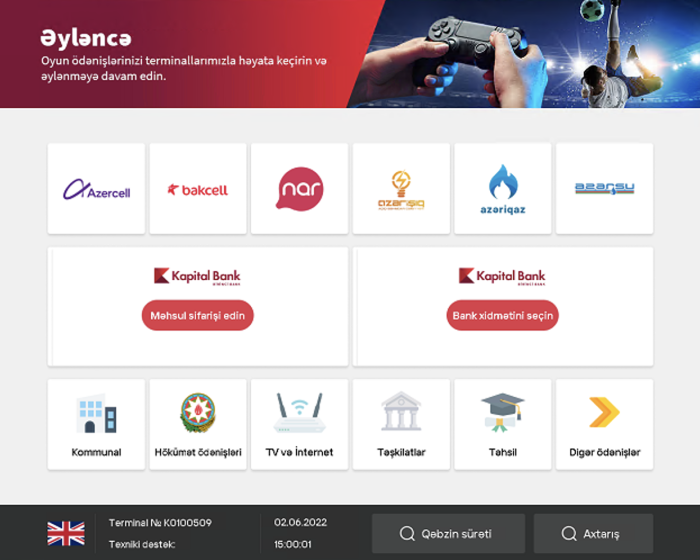

Kapital Bank-ın ödəniş terminalında “Bank xidmətini seçin” menyusu seçilir

1

Kapital depoziti ilə yüksək faiz dərəcələri ilə yanaşı, məbləği müqavilənin bitmə tarixinə 1 ay qalanadək artırma imkanından faydalanın. Üstəlik depozitinizin 80%-dək həcmində nağd kredit və ya kartla kredit xətti əldə edin.

Kapital əmanəti ilə yüksək faiz əldə etməklə yanaşı müddətin yarısınadək məbləğı artıra bilərsiniz.

Aylıq

Müddətin sonu

Ümumi faiz gəliri

3 200 ₼

Hesablamada faiz gəlirlərinə 10% vergi ilə bağlı şərtlər nəzərə alınmayıb.

| Müddət (ay) | Aylıq | Müddətin sonunda | ||||||

| AZN | USD | AZN | USD | |||||

| 20000-dək | 20000-dən çox | 50000-dən çox | 50000-dək | 20000-dək | 20000-dən çox | 50000-dən çox | 50000-dək | |

| 3* | 4% | 4% | - | - | 5% | 5% | - | - |

| 6* | 9% | 7% | - | - | 10% | 8% | - | - |

| 12* | 8% | 8% | 3% | 3.9% | 9% | 9% | 3.3% | 4% |

| 18* | 7% | 7% | - | - | 8% | 8% | - | - |

| 24* | 7% | 7% | 3.1% | 3.1% | 8% | 8% | 3.4% | 3.4% |

| 36* | 7% | 7% | 3.2% | 3.2% | 8% | 8% | 3.5% | 3.5% |

Qeyd:

**Yalnız 12 ay müddətinə 50 000 USD (daxil olmaqla) məbləğinədək rəsmiləşdirilən USD depozitlərinə şamil edilir.

*Yalnız 12 ay müddətinə 50 000 USD-dən daha yüksək məbləğdə rəsmiləşdirilən USD depozitlərinə şamil edilr.

Əmanət üzrə illik faiz dərəcəsi Əmanətlərin Sığortalanması Fondu tərəfindən müəyyən edilmiş qorunan əmanətlər üzrə faiz dərəcəsindən yüksək olduğu halda, müştərinin istəyinə əsasən əmanət, Əmanətlərin Sığortalanması Fondu tərəfindən müəyyən edilmiş qorunan əmanətlər üzrə faiz dərəcəsi ilə qəbul oluna bilər (bu halda müştəridən razılıq ərizəsi alınmalıdır).

Faiz Dərəcələri (Hüquqi Şəxslər üçün)

| Depozit müddəti (aylar üzrə) | Aylıq | Müddətin sonunda | ||

| AZN | USD | AZN | USD | |

| 1 | 4% | 1,0% | 4,2% | 1,2% |

| 3 | 4,3% | 2,0% | 4,5% | 2,2% |

| 6 | 4,5% | 2,5% | 4,7 | 2,7% |

| 12 | 5% | 3,0% | 5,2% | 3,2 |

| 24 | 5,5% | - | 5,7% | - |

| 36 | 6% | - | 6,2% | - |

Qeyd.1: Depozitə minimum 50 000 AZN/USD yerləşdirə bilərsiniz. Maksimal məbləğ üçün isə limit yoxdur.

Qeyd.2: 1,000,000 (bir) milyondan artıq məbləğdə yerləşdirilən depozitlər üzrə şərtlərə fərdi qaydada baxılır.

Qeyd.3: USD valyutasında 12 aydan artıq müddətdə yerləşdirilən depozitlər üçün şərtlərə fərdi qaydada baxılır.

Kapital Bank Ödəniş terminalları vasitəsilə əmanətin artırılması həyata keçirilməsi

Kapital Bank-ın ödəniş terminalında “Bank xidmətini seçin” menyusu seçilir

1

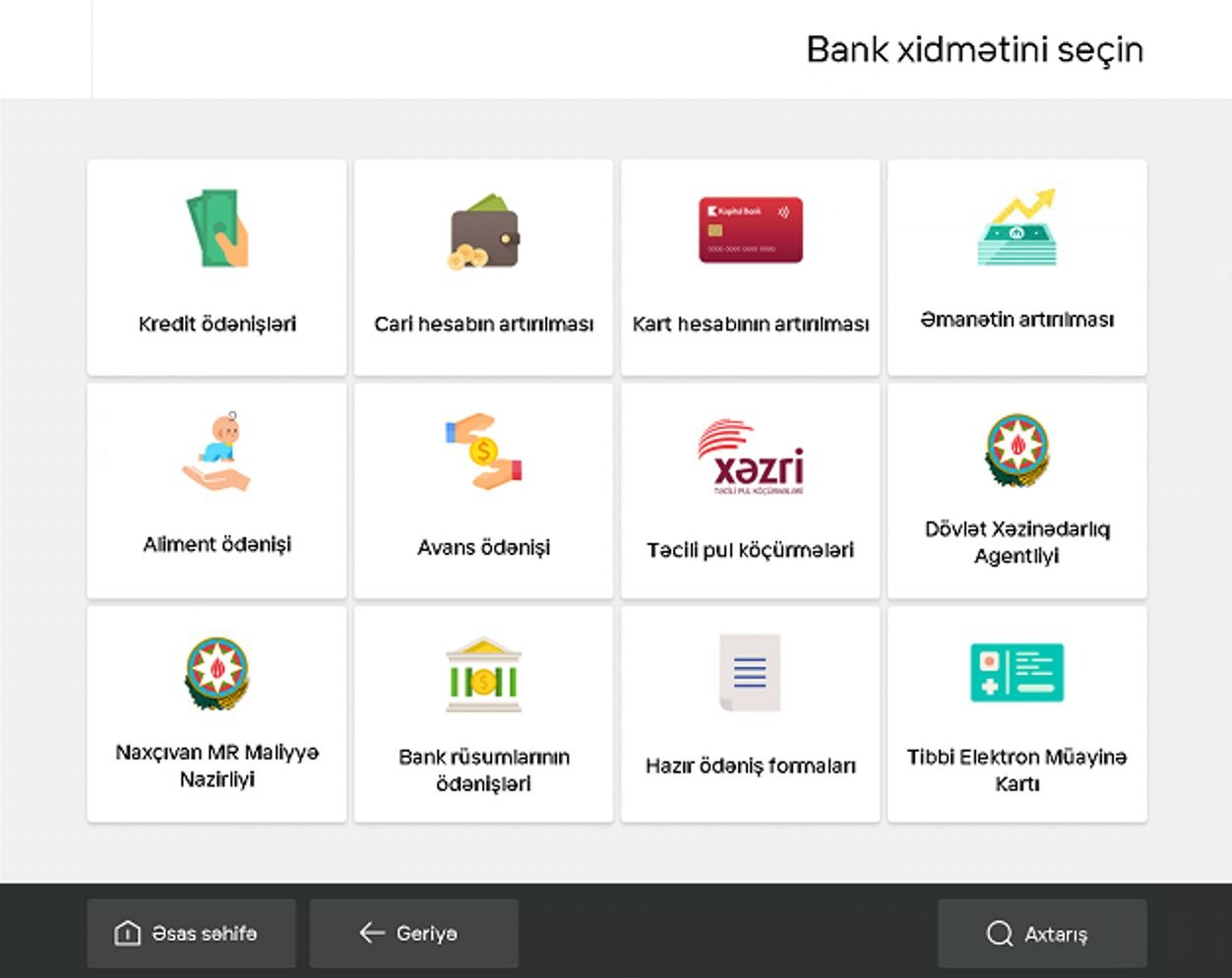

Bank xidmətlərindən “Əmanətin artırılması” xidməti seçilir

2

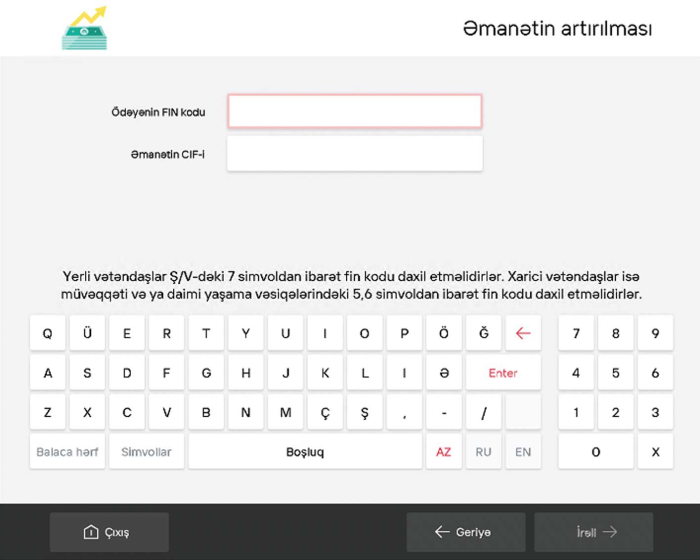

Ödəyənin FİN kodu və əmanətin CİF-i daxil edilir

3

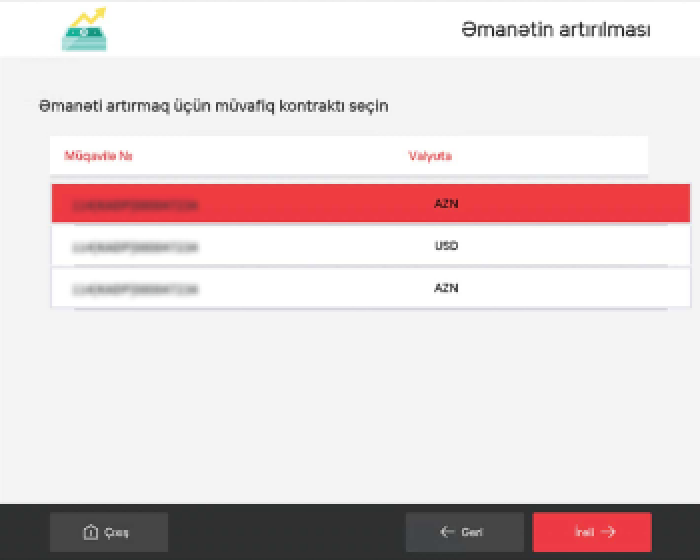

Əmanəti artırmaq istədiyiniz müvafiq müqavilə nömrəsi seçilir

4

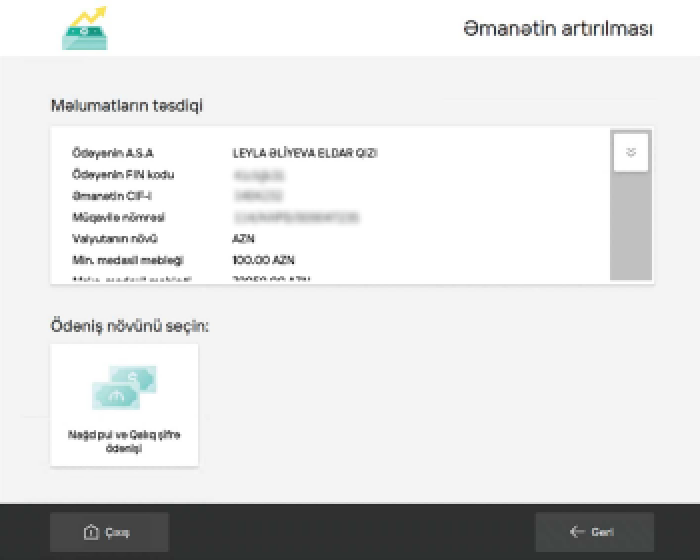

Məlumatların doğruluğu yoxlanılır

5

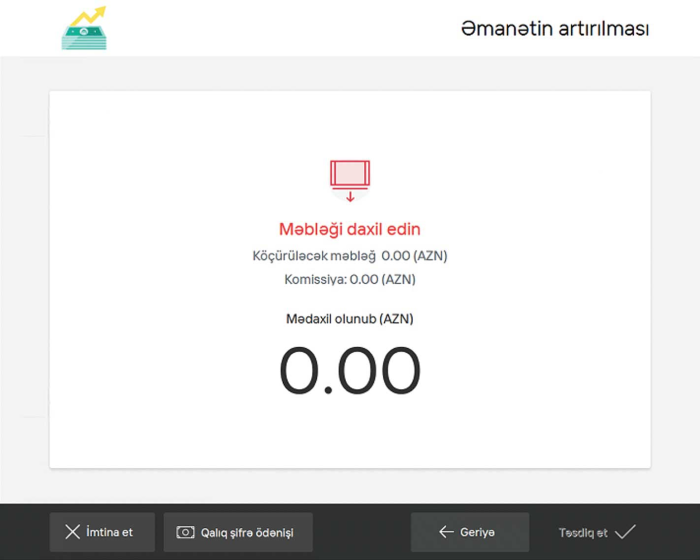

Vəsait terminala daxil edilir və ödəniş təsdiq edilir

6

Depozitlər nağd pulunuzu idarə etməyə başlamağın ən uyğun yoludur. Kapital depozitləri isə sərmayə qoya biləcəyiniz ən sərfəli bank hesablarından biridir. Bu məhsul vəsaitlərinizi saxlamağın etibarlı və gəlirli yollarındandır. Kapital depozitləri sizə yalnızca vəsaitlərinizi dəyərləndirməkdə kömək etmir, eyni zamanda kredit xətti əldə etməyinizə imkan tanıyır. Aylıq və ya müddətin sonunda ödənilən bank depozit faizləri üçün maksimal miqdar 10% olaraq müəyyən edilmişdir. Müştərilərə kredit xətti əldə etmə imkanı tanıyan bu məhsul vasitəsiylə istəyə uyğun olaraq depozit məbləğinin maksimum 80%-i həcmində min.500 AZN/USD olmaqla nağd kredit və ya kartla kredit xətti verilə bilər. Depozit kalkulyatoru ilə faiz miqdarlarınızı asanlıqla hesablaya bilərsiniz. Banka depozit pul qoymaq üçün müraciət etməyiniz kifayətdir.